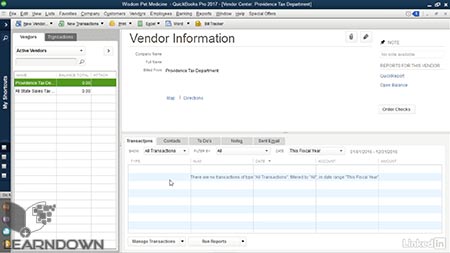

Even if you are not AN accountant, understanding the fundamentals of QuickBooks professional 2017 is AN empowering—and in some cases, essential—skill. during this course, Jess Stratton shows you ways to make and duplicate your company’s QuickBooks file and quickly set up search by adding all of your monetary accounts. additionally, find out about adding merchandise and inventory things. Once you are ready up, Jess walks you thru the every day operations that keep your business running: making estimates and buy orders, sending invoices, process payments, and printing checks. Plus, find out how to run reports, notice data regarding your business, and manage end-of-year preparations.

Topics include QuickBooks Pro 2017:

- Setting up a brand new company file

- Working with the chart of accounts

- Adding bank accounts and credit cards

- Adding service or inventory things

- Setting up excise tax

- Adding client, vendor, and worker profiles

- Billing customers

- Receiving payments

- Recording deposits

- Handling refunds and credits

- Paying staff

- Sharing QuickBooks with others

- Running reports

Leave a Reply